$PFIX Explained

I came a cross a tweet showing @SimplifyETFs's Interest Rate Hedge ETF ($PFIX) having a monster year (+43% YTD as of today). Let's unpack what's inside this fund:

And yeah $PFIX is in league of own, enjoying a monster shiny object moment. It's poss this thing turns into the $DXJ of its day, altho too early to tell. The rocket fuel inside it is OTC traded interest rate swaptions, which are options to enter a swap. pic.twitter.com/09Ni8KaSRh

— Eric Balchunas (@EricBalchunas) April 19, 2022

An interest rate swap is an exchange of cash flows between two parties where party one pays a fixed rate and receives a floating rate and the other party receives a fixed rate and pays the floating rate. A swaption (swap option) gives the holder the option to enter a swap.

And $PFIX holds a bunch of payer swaption (or put swaptions), which give the fund the right but not the obligation to enter into a swap contract where they become the fixed-rate payer and the floating-rate receiver.

This is analogous to having the option to issue a bond at the fixed rate. As a holder of a payer swaption, you expect interest rates to rise and hedge your risk with this lower-than-market fixed payments.

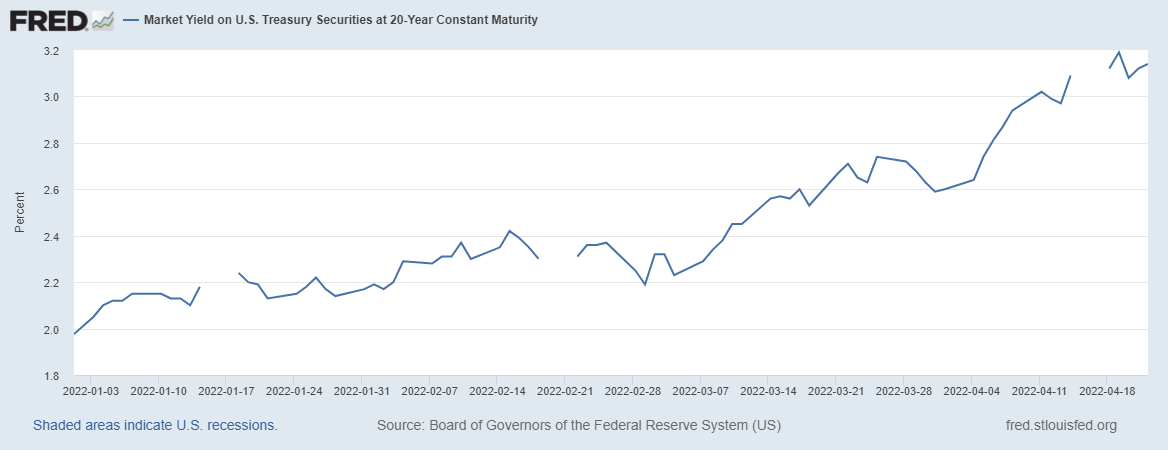

Specifically, the fund holds 7-year payer swaptions on the 20-year rate struck at 4.25%. And as the 20 year yield has been steadily rising, these swaptions have become increasingly more valuable

Hope this helped and this was my third post for #ship30for30!